Especially well-off companies will pay well over $200,000 for the best and also the brightest straight out of school. With the Dow Jones Industrial Standard having raised by 10,000 points over the past four years, there is a firehose of money to be made on the planet of company and also financial. The industry is greatly concentrated in a small number of major monetary centers, consisting of New York City, City of London, Frankfurt, Hong Kong, Singapore, as well as Tokyo.

Under such a technique, a business holds on to companies for as long as it can add significant worth by enhancing their performance and also sustaining development. The company is equally going to deal with those businesses once that is no more clearly the instance. A decision to sell or spin off a company is deemed the end result of a successful change, not the outcome of some previous strategic mistake. At the very same time, the business is cost-free to hold on to a gotten service, offering it a possible benefit over private equity firms, which occasionally have to pass up incentives they `d recognize by holding on to financial investments over a longer duration.

Use sites such as Wall surface Road Sanctuary to research study investment financial tasks as well as learn how to make yourself an optimum prospect. Also, learn more about various specialty locations within investment banking, which might assist fine-tune your task search. Carry out business appraisal analyses by using transaction compensations, marked down capital, and also leveraged acquistion techniques.

The convenience of going public helps UNITED STATE firms enlarge as well as faster than those of various other countries with less developed markets. They have the assistance of roughly 4,500 staffers located in the Washington, DC headquarters and 11 regional workplaces across the nation. It also punishes expert trading, purposeful adjustment of the markets, and selling supplies and bonds without correct enrollment.

Tyler Tysdal and his love of entrepreneurship is as solid now as it was during that ride to the post office with his mom several years earlier. He wishes to “free the entrepreneurs” as his individual experience has certainly freed him through his entire life. When he is not meeting with entrepreneur or speaking with future business buyers, Tyler T. Tysdal spends time with his better half, Natalie, and their three kids.

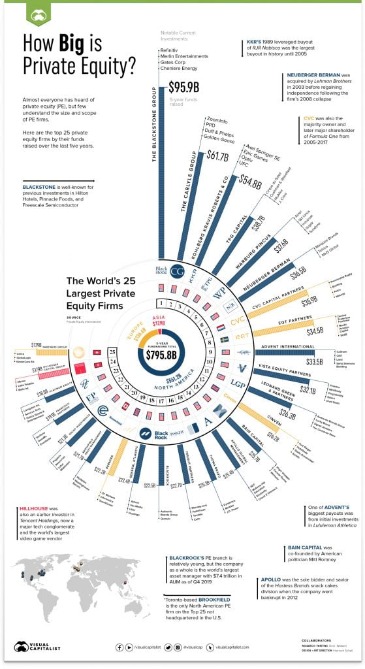

PE companies seek business with strong monitoring teams, repeating customers, high margins, solid annual report, and the ability to create considerable cost-free capital. The most effective candidates are private business that are experiencing quick growth, an administration buyout, or growth right into a new market. They usually have a leading placement in their sector, significant barriers to entrance, and also a separated services or product that regulates a valuation costs over the competitors. Some private equity companies are easy capitalists, choosing to stay investors that depend on the existing management of a target company to expand the business and improve success.

The SEC has developed a searchable online data source called EDGAR, which companies are needed to use to submit reports, types as well as other info needed by the SEC. The Glass-Steagall Act created the Federal Down payment Insurance coverage Company to look after financial institutions, safeguard consumers` financial institution deposits and also manage customer issues. At SEC, Walter increased to become associate general advise and replacement supervisor of the Division of Company Finance. Walter left the SEC in 1994 at the demand of Mary Schapiro, that had actually become her mentor at SEC, to function as basic advise of the Product Futures Trading Commission. In January 2002, White returned yet once more to Debevoise as a partner, specializing in clerical criminal defense and essentially defending the exact same sort of people from the exact same type of costs as she had been prosecuting the previous decade. These costs as well as other actions showed “a pattern of Congress`s getting the steering wheel of an independent company,” which Levitt said have to quit. Most just recently, Congress took on the 2,300-page Dodd-Frank economic reform regulation as well as demanded the SEC apply it– while not increasing the company`s budget one dollar.

Investor as well as venture capital funds invest in startup firms at various phases of business life cycle. The 3 main sorts of financial backing are seed funding, early-stage funding, and late-stage funding. The biggest downside of PE investments is that local business owner should surrender control.